Key Takeaways

- Blooma integrates directly with your existing LOS and CRM, adding automation and AI without disrupting workflows.

- It enables a two-way data flow where information moves in, is analyzed by AI, and enriched insights are pushed back into your core platforms.

- Blooma processes a wide range of data, including rent rolls, borrower profiles, market comps, and risk alerts, all of which are standardized and unified.

- It improves efficiency and accuracy by eliminating manual re-keying, reducing errors, and giving underwriters a complete view in their familiar tools.

- Integration is quick and minimally disruptive, helping you adopt faster while maximizing the value of your current technology stack.

The Power of a Connected Ecosystem

Having a tech stack made up of isolated tools can result in inefficiencies and added costs. Disconnected systems lead to duplicate data, slow workflows, and missed insights. Imagine having to build out a puzzle where pieces are found in different boxes. You may know that it’s there, but the time it takes to find it and piece it together is unnecessary. This can be said the same with your tech stack.

You need a stack that can work together, so if you’re wondering whether Blooma can integrate with your LOS or CRM environment, the answer is yes. Blooma is explicitly built for integration, and it adds an intelligence layer designed to plug into your existing lending software, adding AI, automation, and richer insights instead of replacing your core systems.

A study revealed that 88% of the decision-makers in the U.S. financial service institutions report that data silos and disconnected systems can significantly hamper timely decision-making, highlighting the importance of adopting a connected ecosystem.

Blooma automates repetitive, time-consuming tasks, allowing underwriters to focus on more pressing matters, such as analyzing deals and managing portfolios. With Blooma, you get enhanced deal screening, borrower profiling, risk scoring, and portfolio monitoring—all feeding data back into systems you already use.

In this article, we’ll review the mechanics of how Blooma can integrate with your existing LOS and CRM software, detailing the data exchange and the key benefits of creating seamless, connected lending workflows.

The Mechanics of Seamless Integration

Blooma connects your LOS and CRM through APIs (Application Programming Interfaces). APIs are the connection points that let different software exchange information smoothly, ensuring data moves between systems without disruption.

Two-Way Data Flow

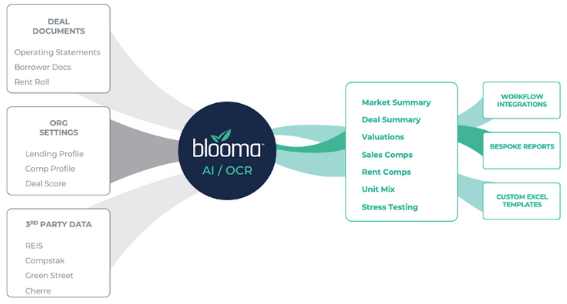

- Data In: Blooma securely pulls deal data, borrower information, and supporting documents directly from your LOS or CRM.

- AI Processes & Analyzes: The platform automates data extraction, spreads financials, evaluates market conditions, and runs risk assessments.

- Insights Out: You gain access to actionable insights, and enriched data flows back into your LOS or CRM, giving your team a clear, unified view without switching tools.

For instance, a regional bank using Blooma reduced loan processing times by up to 85%, allowing the same team to handle 50% more transactions without adding headcount. This highlights the impact integrations can have on capital gains.

Your Central Hub

Blooma acts as a central hub that moves and standardizes data. By connecting your core systems with trusted third-party providers—such as property comps, market benchmarks, and credit data—our platform creates a consistent source of truth, eliminating discrepancies, reducing manual reconciliation, and accelerating decision-making.

A recent study found that 95% of U.S. financial institutions already use APIs to streamline operations. This shows that APIs have now become the standard for connecting financial systems.

What Data Flows Between Your Systems?

Here’s how our platform extracts, enhances, and returns data, giving your team actionable insights without manual re-typing.

- Rent rolls, financial statements, tax returns, and offering memoranda are automatically parsed and standardized.

- Blooma reads and structures unstructured documents so key information can surface without manual efforts.

- For every deal, metrics like loan amount, debt service coverage ratio (DSCR), loan-to-value (LTV), borrower credit profile, guarantor information, and historical cash flows are extracted and analyzed.

- Live data from third-party sources (market comps, cap rates, economic indicators) is integrated to enrich deal analysis.

- These feeds help underwriters assess valuation trends and local market dynamics.

- Blooma generates analytics such as deal scores, risk alerts, and performance dashboards.

- These insights are pushed back into your LOS or CRM so you can see portfolio health, detect risk early, and act accordingly.

Key Benefits of a Connected Ecosystem

Here are some of the core advantages you can gain by integrating Blooma with your existing LOS/CRM:

- Maximizes Your Technology Investment

- Blooma enhances your current LOS or CRM, extending its life and increasing its value.

- By integrating instead of replacing, you save on licensing, training, and migration costs while still gaining enhanced deal scoring, risk assessment, and portfolio monitoring.

- Reduced Friction and Enhanced Efficiency

- Unified Insights in One Place

- AI-driven insights and live market intelligence show up within your familiar systems.

- You no longer need to jump between screens or spreadsheets; everything from borrower profiles to cap rates appears in context, in your core tools.

- Faster Implementation & Adoption

- Integrating existing workflows is substantially quicker and less disruptive than a complete system overhaul.

- Training is lighter because your team uses familiar systems, with Blooma augmenting rather than replacing tools.

- Automated data processing and synchronization across systems reduce human error and ensure consistency.

- When information is auto-matched and updated, the risk of mismatched or stale data drops drastically.

A PwC benchmarking study found that top-quartile finance functions operate at 30–40% lower cost than the median, with opportunities to cut 35–46% of effort in key processes such as reporting, general accounting, and reconciliations through automation and standardization.

Upgrade Your Lending without the Overhaul

You don’t need to replace your core lending software to benefit from automation and AI. Blooma is designed for seamless integration, not disruption. Connecting with your existing LOS and CRM enhances the tools your team already knows—adding speed, accuracy, and real-time intelligence without the pain of a system overhaul.

Ready to see how Blooma can seamlessly integrate with your LOS and CRM to transform your lending operations? Schedule a personalized demo today to discover the power of intelligent automation without the pain of a “rip-and-replace”.

People Also Ask (FAQs)

- How does Blooma integrate with my existing LOS and CRM?

- Blooma uses secure APIs to connect and sync with your current platforms. This allows for a seamless, two-way data flow that enhances your existing workflows without requiring you to switch systems.

- How long does the integration take?

- Because Blooma is designed for seamless integration and not complete replacement, implementation is significantly faster and less disruptive than a complete LOS overhaul. Our team works to get you up and running quickly.

- What is an "intelligence layer"?

- An intelligence layer is a technology platform that sits on top of your existing systems, pulling data in for analysis and pushing insights back out. It enhances your current capabilities with features like AI and automation, without being a core system itself.

- How does Blooma handle data security during integration?

- Blooma prioritizes data security with robust encryption, strict access controls, and compliance measures. Our platform is built to handle sensitive financial data securely and aligns with industry best practices for data protection during the integration process.