Commercial Real Estate Underwriting Software

Blooma’s Commercial Real Estate Underwriting Software

The Evolution of Commercial Real Estate Underwriting

Traditionally, this equates to a lot of work, filled with inefficiencies and many opportunities for simple errors.

Stacks of paperwork, rows of spreadsheets, and countless hours spent manually crunching numbers to assess real estate property values, cash flows, and risk factors.

But then, digital innovation emerged and changed the game.

Suddenly, what once took days, weeks, or even months to accomplish could now be achieved in a fraction of the time. Spreadsheets were replaced by sleek, user-friendly interfaces, and manual data entry became a relic of the past.

With the advent of underwriting software like Blooma, the entire landscape of CRE began to shift.

Lenders found themselves armed with powerful tools that could analyze vast datasets in real-time, providing actionable insights at the click of a button. Borrowers, too, reaped the benefits, enjoying faster, more streamlined loan origination processes that allowed them to seize opportunities with unprecedented speed and agility.

In the context of 2024, it’s all the more important as the CRE market faces uncertainty and optimizing investments to stay afloat is a must.

But perhaps most importantly, the rise of underwriting software marked a fundamental shift in the way we approach CRE investment.

No longer bound by the constraints of manual data entry or limited by the capacity of traditional underwriting methods, investors can now take advantage of the full power of technology to unlock new opportunities, optimize their portfolios, and drive greater profitability.

The best part?

With Blooma leading the charge, the future has never looked brighter.

Key Features of Commercial

Real Estate Underwriting Software

So why get started with Blooma? Here are the key features to know.

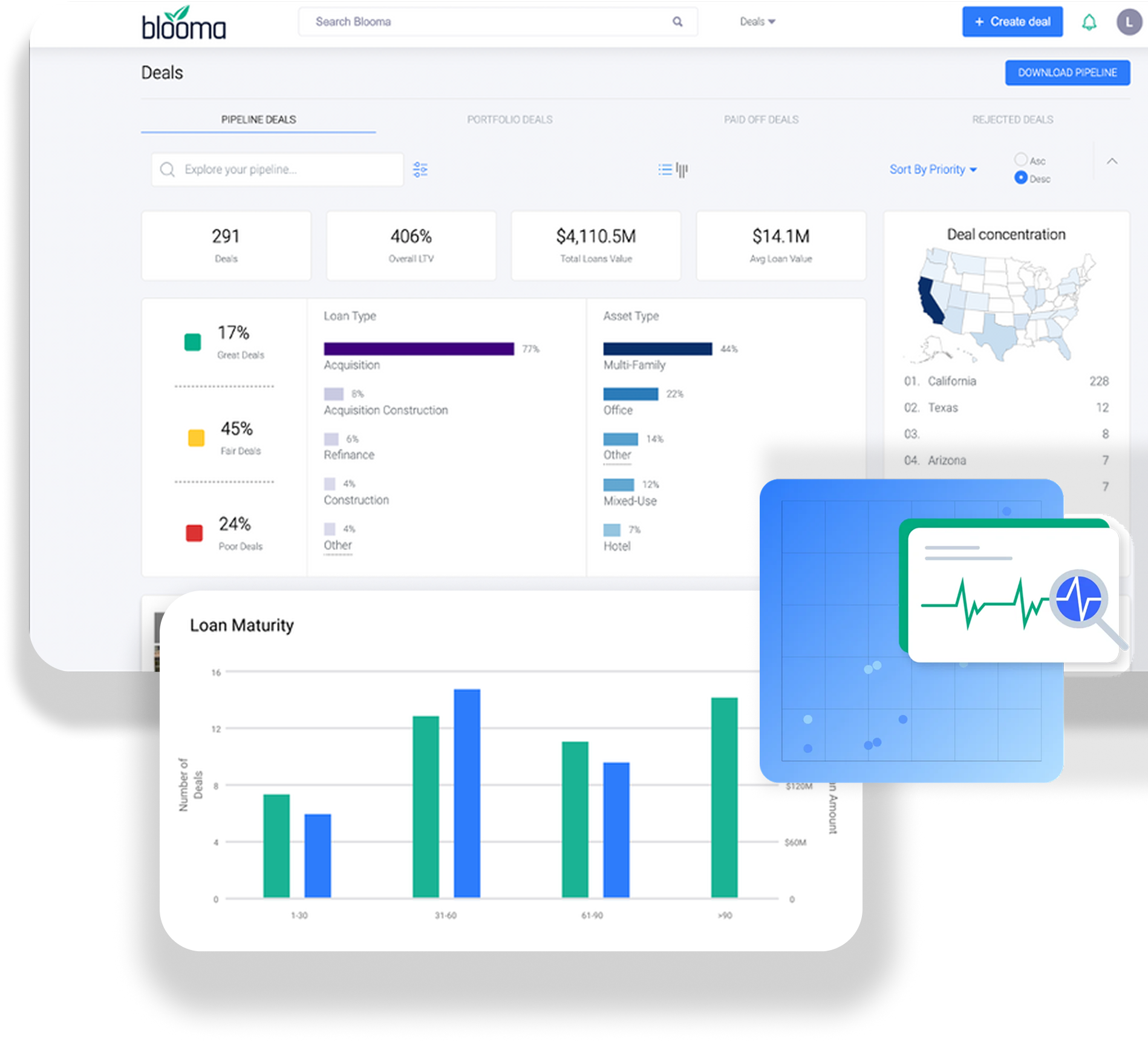

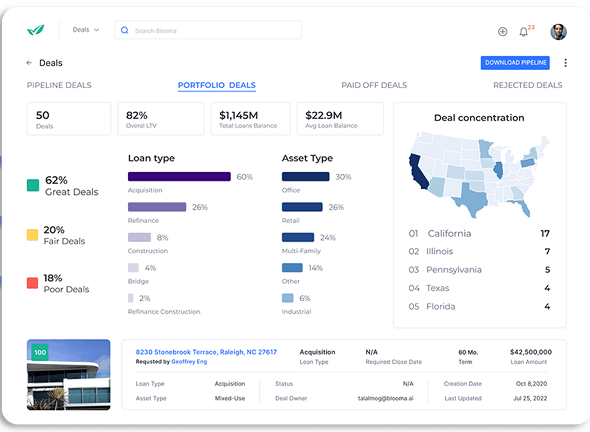

Blooma is designed to streamline the collection and analysis of critical data points, from property valuations and cash flows to market trends and risk factors.

By automating these processes, our underwriting software allows professionals to quickly and accurately assess the financial health of potential investments, saving valuable time and minimizing the risk of errors.

Fortunately, Blooma comes equipped with sophisticated risk assessment tools that leverage advanced algorithms and predictive analytics to evaluate potential risks with precision.

From assessing market volatility and tenant stability to forecasting cash flow projections and debt service coverage ratios, these tools provide invaluable insights that empower lenders and investors to make informed decisions and mitigate potential risks.

Thankfully, commercial real estate underwriting software is designed to simplify compliance by ensuring adherence to legal standards and regulations.

With built-in compliance checks and automated reporting features, Blooma can help users stay on top of regulatory changes, minimize compliance risks, and maintain the integrity of their operations.

Whether it’s integrating with property management systems, CRM platforms, or financial modeling tools, Blooma allows users to centralize their data and workflows, eliminating silos and streamlining collaboration across teams.

This integration boosts your productivity levels while also feeding into a more holistic approach to underwriting and portfolio management.

Blooma boasts a user-friendly interface that makes the underwriting process accessible to professionals of all levels of experience.

With intuitive dashboards, customizable templates, and interactive visualizations, these tools simplify complex financial concepts and empower users to navigate the underwriting process with ease.

This means both seasoned experts and newbies can quickly get up to speed and start making smarter, more informed decisions.

Benefits of Implementing

Underwriting Software in CRE

Here’s how you stand to benefit from using Blooma today.

Efficiency and Time-Saving

Tasks that once took hours or days to complete can now be accomplished in a fraction of the time, thanks to automation and advanced data analysis capabilities in Blooma.

Your CRE professionals can expedite tasks such as data collection, financial analysis, and risk assessment, allowing them to focus their time and energy on more strategic aspects of deal evaluation and decision-making.

Accuracy and Reliability

Human error is an inherent risk in manual underwriting processes, but Blooma helps mitigate this risk by delivering unparalleled accuracy and reliability.

By automating calculations, data entry, and analysis, underwriting software minimizes the potential for errors and inconsistencies in underwriting reports and financial models.

Scalability

Blooma is a perfect fit for any firm, regardless of the different sizes of portfolios and deal volumes.

Whether managing a single property or a diverse portfolio of assets, Blooma can accommodate varying levels of complexity and scale seamlessly.

Enhanced Decision Making

Blooma empowers CRE professionals with in-depth market insights and analytics, enabling you to make more informed and strategic decisions.

By aggregating and analyzing vast amounts of data in real-time, underwriting software provides valuable insights into market trends, asset performance, and investment opportunities.

Explore Our Products

Frequently Asked Questions

What makes commercial real estate underwriting software different from traditional methods?

How does this software contribute to risk management in CRE?

Can the software be integrated with existing CRE management systems?

What kind of support and training is available for new users?

How does underwriting software stay updated with changing regulations?

Choosing the Right Software for Your Needs

Here are some tips to help you select the best cloud-based CRE software solution tailored to your needs:

- Define Your Requirements: Consider factors such as the size and complexity of your CRE portfolio, your budget constraints, and any unique features or functionalities you may require.

- Assess Features and Functionality: Look for key features such as automated data analysis, risk assessment tools, integration capabilities, and a user-friendly interface. Consider whether the software aligns with your workflow and can streamline your underwriting process effectively.

- Consider Scalability: Choose a software solution that can scale with your business as it grows, accommodating changes in the size and complexity of your CRE portfolio without compromising performance or efficiency.

- Evaluate Integration Capabilities: Check whether the underwriting software can seamlessly integrate with your existing CRE management systems and other software tools.

- Consider Customer Support and Training:Look for providers that offer live support, online tutorials, user manuals, and training sessions to help you get the most out of the software.

Contact Us

Blooma is using technology to revolutionize commercial lending. Our CRE software will help you scale your real estate empire efficiently and profitably. Plus, Blooma plugs seamlessly into your existing tech stack so you won’t miss a single deal waiting on software implementation.

But don’t take our word for it. Schedule a demo today and see how Blooma can help your commercial real estate company bloom.

Book Your Demo!

Why Blooma Stands Out

or consultation.