Deals are moving faster. Your workflow isn’t.

While your team hunts down data across spreadsheets and disconnected tools, the competition is closing with AI-powered confidence. In commercial real estate lending, time isn’t just money—it’s momentum. And the systems you rely on are quietly slowing you down.

AI promises a smarter, faster way forward. But most CRE teams aren’t seeing that promise materialize. Not because the technology is lacking, but because the data isn’t ready for that.

It’s not about access to tools. It’s because the data they rely on is scattered across too many places.

Before discussing AI strategy, you need to examine the data structure. And if your systems can’t talk to each other, your AI can’t help you. Let’s break down why that’s the real problem and how smart teams are solving it.

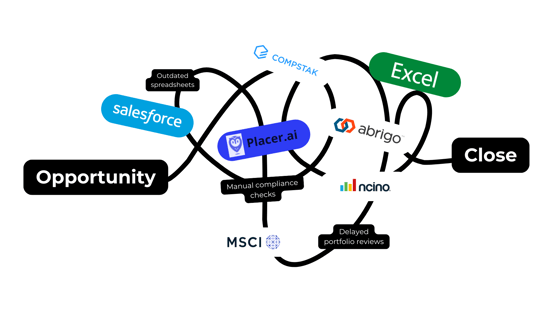

Source: Blooma

The Data Silo Dilemma in CRE

Forget AI for a second. Google how to break down data silos and you’ll get flooded with technical frameworks: data lakes, governance layers, cloud migrations, cloud data warehouses, etc. It’s overwhelming, and if you’re thinking, I don’t have time to learn all this, you’re not alone. Most of it feels disconnected from how CRE actually works.

So let’s simplify it. Data silos occur when your systems, teams, or vendors fail to communicate with each other.

The most common culprits are:

- Departments operating in isolation

- A software stack made up of disconnected tools

- Vendors want to keep your data in their ecosystem, not yours.

- Outdated technology that doesn’t integrate

One CRE firm, for example, reported using 40 different systems to track property data, none of which communicated with each other. Sound familiar?

If the promise of AI is real-time insights, why are we still relying on systems that don’t share information? Let’s understand why it’s a problem.

Siloed Data Doesn’t Just Slow You Down. It Breaks AI.

AI isn’t magic, it’s a tool. And like any tool, it’s only as good as the materials it’s given to work with.

In CRE, those materials are your data. And when that data is scattered across PDFs, spreadsheets, email threads, legacy systems, and disconnected platforms, AI can’t do its job. You’re not just slowing down workflows, you’re actively compromising the integrity of your outputs.

Here’s what fragmented data really causes:

- Duplicate reports that can’t be reconciled

- Missing context that leads to incomplete conclusions

- Outdated assumptions that are never updated in real time

- Siloed access, so teams operate on different versions of the truth

AI relies on consistency, context, and structure, none of which are possible when your data is isolated.

As Urban Land Institute states:

“Even with AI, garbage in still yields garbage out.”

But the problem isn’t just operational. It’s also philosophical.

Much of CRE’s data isn’t just messy, it’s deliberately guarded. In private markets, holding data close is often viewed as a competitive edge.

“Unless federal, state, or local jurisdictions mandate that specific data be released,” one expert noted in Urban Land Institute article, “investment professionals are going to keep as much data as they can to themselves… because that’s what makes one investment manager better than the other.”

But here’s the disconnect: The future of decision-making relies on access, not exclusivity. Data hoarding may protect short-term advantage, but it blocks long-term scalability.

You can’t automate what you can’t access.

You can’t optimize what you can’t normalize.

And you definitely can’t innovate if your platform can’t see the full picture.

Walled Gardens Don’t Scale

In theory, centralized platforms should help unify your data. But in practice, many of these tools do the opposite.

They create walled gardens, systems that only work with their own data, in their own ecosystem, and on their own terms.

Yes, they might offer powerful features.

Yes, they might feel like the “safe” option.

But if they don’t integrate, interoperate, or adapt, they’re just another form of vendor lock-in.

This is especially risky in CRE, where real estate data:

- Comes from dozens of internal and external sources

- Is often housed in legacy platforms that don’t play well together

- Requires human context and cross-team collaboration to make sense of

When your platform can’t or won’t connect with others, it forces your team to work harder, not smarter. It blocks your ability to adapt your stack, onboard new tech, or unify insights across the organization.

Even worse, it perpetuates the private-market gatekeeping mindset that already limits data access in CRE.

If the point of AI is to uncover better decisions faster, why are you investing in systems that keep your data locked away?

Walled garden might offer control. But open ecosystems offer compounding value, where every additional connection makes your data more useful, not less.

In a market defined by complexity, you don’t need more control. You need more connection.

Plug in. Don’t Start Over.

We’re not asking you to rip and replace. Blooma integrates directly with your existing CRE platforms, pulling deal, borrower, property, and market data via API. So your teams don’t have to bounce between disconnected systems or duplicate efforts just to get a full picture.

Data aggregation and integration are one of the biggest headaches in CRE lending.

Blooma eliminates that friction by bringing together data from property records, borrower financials, market comps, and internal documents, all into one centralized platform. That means no more toggling between tools or piecing together the story manually.

Modern CRE workflows demand more than speed. They require clarity. Blooma connects these disparate data sources, breaking down the silos that slow down decision-making and obscure risk.

We don’t just make AI usable, we make your data visible, standardized, and decision-ready.

Blooma acts as the connective tissue, transforming fragmented information into structured insights and providing your team with a single platform to screen deals, assess risk, and move with confidence.

It’s not that your tech can’t support AI. It’s that AI can’t reach its full potential unless your systems are connected—and your data is clean, structured, and accessible.

Step 1: Democratize Your Data

Once your systems are connected and your data is flowing, the next step is making that information usable, not just by AI, but by your team.

Data democratization means making accurate, timely information accessible across your organization, not just to analysts or IT power users. It’s how you shift from a siloed mindset to a culture of shared insight.

As Blooma’s CEO and CTO, Shayne Skaff & Tal Almog put it:

“We want our users’ data to talk to other data.”

Because when that happens:

- Context improves

- Decisions are made faster

- Insights aren’t bottlenecked in one department

- AI becomes an amplifier, not a risk

This isn’t about data anarchy, it’s about giving the right people the right access at the right time. When people are empowered to interact with that data themselves, AI becomes less of a black box and more of a natural extension of the team.

The result? Better decisions. Strong strategy. More collaboration. And a more adaptive organization.

Step 2: Choose Platforms That Connect, Not Control

The final step isn’t about buying the “best” new tool. It’s about choosing the one that plays well with what you already have.

This isn’t about ripping and replacing. It’s about choosing tools that integrate, not isolate.

Your AI journey doesn’t require a total system overhaul. But it does require platforms that play well with others.

That means avoiding systems that:

- Keep your data hostage.

- Require custom integrations for basic workflows.

- Only work within their own closed loop.

And instead, adopting platforms that:

- Connect easily across your existing stack.

- Normalize unstructured and structured data.

- Enable human-in-the-loop decision-making.

- Serve as the connective tissue—not the silo.

Because if your platform can’t talk to other platforms, it’s not a solution—it’s just a prettier version of the same problem.

The goal isn’t control. The goal is connection. That’s what turns AI from theory into value, and turns your data from a liability into a strategic asset.

Final Thought: Don’t Just Buy Tech. Unblock It.

If you’re serious about using AI in CRE, stop thinking about features and start thinking about foundations.

The real blocker isn’t AI readiness. It’s siloed data strategies, outdated systems, and closed platforms.

AI is here. The value is real. But only if your infrastructure is ready to support it.

If you're ready to connect your data, your systems, and your insights, Blooma can help.