Imagine closing a complex CRE loan before your competitors even finish their first spreadsheet.

In today’s high-stakes commercial real estate market, deals are won by those who move fast and smart. Yet traditional lending processes remain bogged down by delays, guesswork, and manual reviews. The question isn’t if there’s a better way—it’s how fast you’re ready to adopt it.

The commercial real estate lending industry faces unprecedented pressure to evolve. As market conditions fluctuate and competition intensifies, financial institutions find themselves at a crossroads:

- Either continue with traditional methods that rely heavily on manual effort

- Or embrace the transformative power of artificial intelligence and intelligent automation.

AI lending represents more than just a technological upgrade.

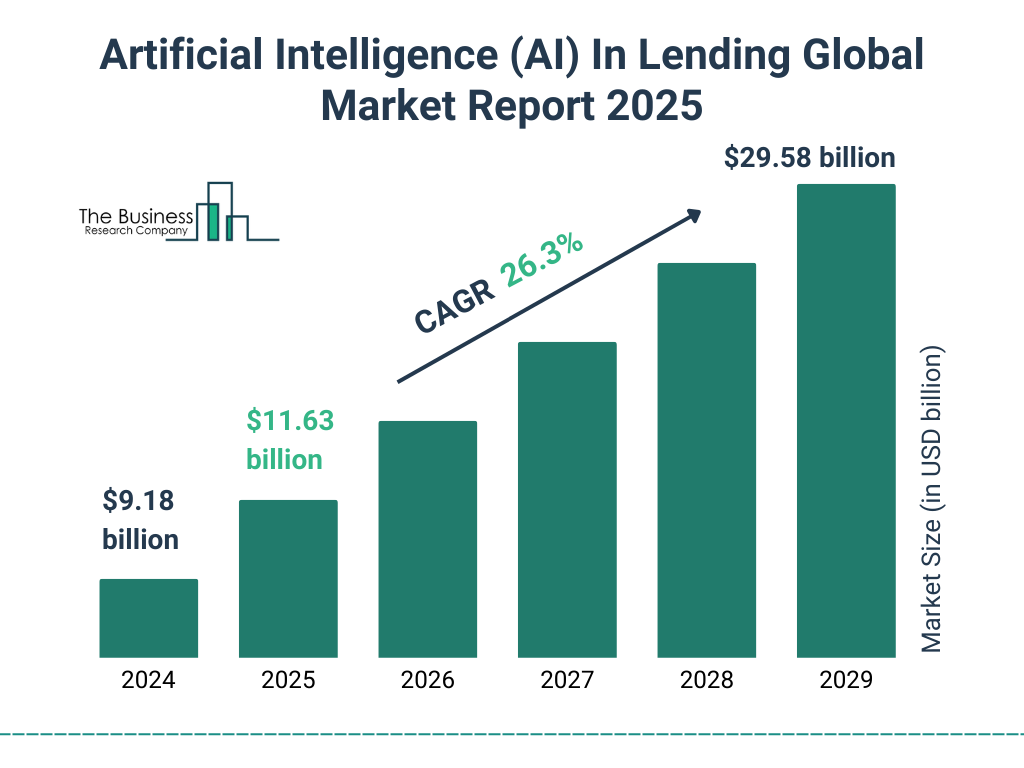

Source: The Business Research Company

It’s a fundamental shift in how lenders approach the entire lifecycle of commercial real estate loans. For innovative financial institutions, it’s a chance to eliminate long-standing friction points and outpace competitors in a rapidly evolving landscape.

At the heart of this transformation is Blooma, delivering intelligent CRE software that takes the grind out of underwriting. By automating routine workflows, Blooma frees up lenders to focus on what matters most: strategic thinking, nuanced risk assessment, and relationship-driven deal-making.

In this article, we’ll explore how AI is reshaping CRE finance—and how Blooma equips lenders with the tools to lead this shift and unlock long-term market advantage.

The Challenges of Traditional CRE Lending

Commercial real estate lending has been plagued by processes that consume too much time and resources and introduce unnecessary risk. These obstacles to efficiency and growth are:

- Manual Data Entry and Processing: McKinsey found that underwriters spend 40% of their time on repetitive tasks like extracting information from documents and entering data into multiple systems. This slows down the lending process and introduces human error that can be costly.

- Fragmented Data Sources: Critical information for lending decisions is scattered across multiple systems and formats. Gathering comprehensive data on properties, borrower credit history, market conditions, and comparable properties requires accessing multiple platforms and consolidating information manually.

- Inefficient Workflows: Traditional lending processes involve many department handoffs, creating bottlenecks and delays. From loan origination to final approval, inefficient workflows extend time-to-decision and frustrate both internal teams and customers.

- Time-Consuming Underwriting: Commercial real estate deals require thorough risk assessment that traditionally takes days or even weeks to complete. This delays customer satisfaction and can result in lost business when borrowers go to faster competitors.

- Difficulty in Portfolio Monitoring: Banks and financial institutions struggle to have real-time visibility into their loan portfolios. The challenge of monitoring large amounts of dynamic data means risk indicators often go undetected until audit periods, which is too late for proactive intervention.

The Power of AI in CRE Lending

Artificial intelligence is changing the way commercial real estate lending works, solving these long-standing problems from traditional CRE lending systems:

- Automation of Manual Tasks: AI systems can extract and process information from diverse document types such as rent rolls, financial statements, and property assessments with remarkable speed and accuracy. Machine learning algorithms continuously improve, recognizing patterns and formats to automate what was once painstaking manual work.

- Enhanced Data Aggregation and Analysis: By leveraging AI, lenders can seamlessly integrate data from multiple sources to create comprehensive profiles of properties and borrowers. Natural language processing capabilities allow systems to understand and analyze unstructured data, transforming it into actionable insights for lending decisions.

- Streamlined Underwriting and Risk Assessment: AI-powered credit scoring models evaluate borrower risk more comprehensively than traditional methods, considering hundreds of variables simultaneously. These sophisticated risk management tools deliver consistent, data-driven assessments that minimize bias while maximizing accuracy.

- Real-Time Portfolio Monitoring: Advanced AI analytics enable continuous monitoring of loan portfolios, identifying emerging risks before they become problems. This proactive approach allows financial institutions to address issues early, protecting their investments and strengthening relationships with borrowers.

Blooma’s AI-Powered Solutions for CRE Lenders

Blooma’s commercial lending software harnesses the full potential of AI to address the specific needs of commercial real estate lenders. It does this through main leading solutions.

Origination Intelligence

Blooma’s platform automates the preflight and underwriting process. The system extracts and validates data from documents, does preliminary credit analysis and standardizes information for consistent evaluation.

This speeds up the response to opportunities from minutes to days and can improve customer experience and the win rate on competitive deals while boosting business confidence.

Portfolio Intelligence

The Blooma platform provides unprecedented visibility into loan portfolios through AI-powered monitoring and analytics. The system updates property valuations, monitors borrower performance metrics, and alerts teams to potential issues before they become problems.

This level of oversight was considered impossible with traditional systems but is now done at the click of a finger with Blooma.

Key Blooma Benefits

- Increased Efficiency: By automating up to 80% of manual data collection and entry tasks, Blooma frees lending professionals to focus on relationship-building and strategic analysis.

- Improved Accuracy and Reduced Risk: AI-driven validation and verification processes minimize human error and ensure consistent application of lending criteria.

- Faster Decision-Making: Streamlined workflows and instant access to comprehensive data enable rapid yet thorough evaluation of lending opportunities.

- Enhanced Portfolio Visibility: Real-time dashboards and automated alerts provide continuous oversight of loan performance.

- Scalable Growth: Institutions can expand their lending operations without proportional increases in staffing costs.

The Future of CRE Lending with AI

The integration of AI into commercial real estate lending is just beginning, with several emerging trends poised to further transform the industry.

- Continued Automation: As machine learning algorithms get smarter, we’ll see more automation of more complex parts of the lending process. This will mean even more efficiency gains and lower operational costs.

- Advanced Analytics: Predictive models will incorporate more data sources, including alternative data that provides deeper insight into property performance and borrower behavior. This will mean more nuanced lending decisions and creative deal structuring.

- Personalized Lending: AI will enable the creation of highly customized loan products that match the evolving needs of borrowers. This will go beyond terms and rates to include customized servicing and communication.

- More Transparency and Efficiency: Blockchain and AI will combine to create more transparent, secure, and efficient lending processes, potentially changing how loans are originated, traded, and serviced across the banking sector.

Blooma continues to lead innovation in this space, working closely with clients to develop solutions that address the challenges of today while anticipating the opportunities of tomorrow.

By continuously enhancing its mortgage lending software capabilities through AI advancement, Blooma is helping shape a future where lending is more accessible, efficient, and precise.

Embracing the AI-Powered Future of CRE Lending

AI in lending is no longer a future trend or a mere possibility. It’s here now, and it’s changing the dynamic landscape of commercial real estate finance. The institutions gaining a significant market share are those taking advantage of AI as more than an efficiency tool. Those who recognize its potential as a strategic asset capable of boosting every stage of the lending lifecycle and making informed decisions will get ahead.

From automating loan origination to transforming risk assessment and portfolio management, AI delivers speed, accuracy, and deeper insights that traditional methods simply can’t match.

Financial institutions that adopt these technologies are better equipped to manage risk, respond to market shifts, and serve clients with greater precision.

Blooma’s AI-powered CRE lending platform makes this transformation real. By eliminating manual bottlenecks and enabling smarter data analysis, Blooma helps lenders refocus on what truly matters: building relationships, crafting smart deals, and making high-impact decisions.

Ready to unlock smarter, faster, and more profitable lending? Partner with Blooma and step confidently into the future of commercial real estate finance.

Get started with a demo today!