As artificial intelligence and large language models rapidly reshape industries globally, a critical question echoes through commercial real estate and insurance: Will AI replace underwriters in the next five years?

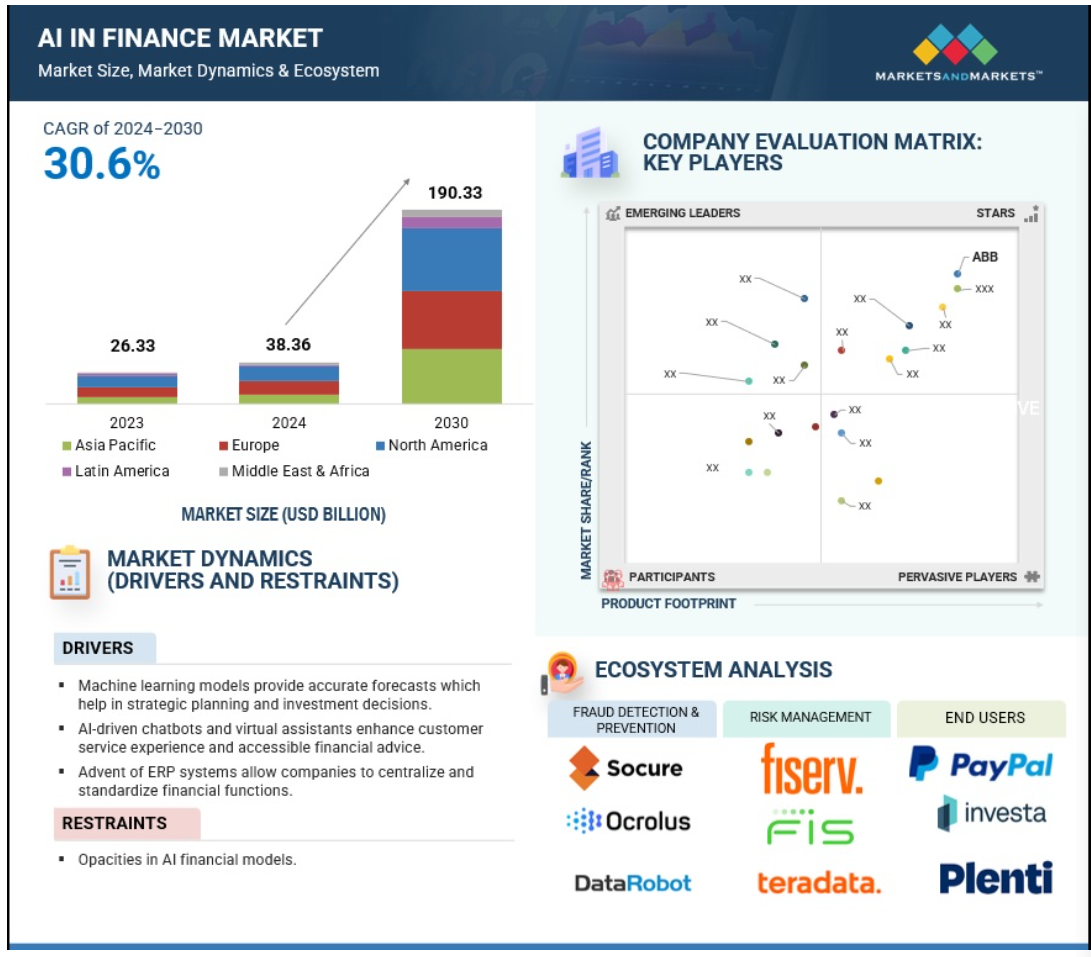

According to recent research, the global AI in financial services market is projected to grow at a compound annual rate of 23.5% through 2030, indicating a seismic shift in how underwriting work is conducted.

Yet this technological revolution raises profound questions about the future of human experience and judgment in an increasingly automated field burgeoning with new tools.

Underwriting, the process of evaluating risks to determine lending decisions, has traditionally been a highly human-centered discipline requiring experience, relationship management, and research-backed, crucial judgment.

However, today, AI systems are being deployed across the insurance industry and commercial real estate lending to revolutionize how risks are assessed and decisions are made. But is technology truly on track to replace underwriters and become an essential tool, or is something more nuanced happening?

This article explores the current applications of AI in underwriting, its benefits and limitations, and makes the case that the future isn’t about replacement but strategic shifts that transform the underwriter’s role while preserving the irreplaceable human element that drives the business forward.

Current Applications of AI in Underwriting

The integration of artificial intelligence into underwriting processes is already well underway, with several key applications you should be aware of as you start to access and tap into it.

Data Collection and Analysis

AI can gather, organize, and analyze vast amounts of vital data from multiple sources. In commercial real estate lending, that means pulling property values, market trends, tenant information, and neighborhood data that would take underwriters days to compile manually.

Blooma’s platform uses this to turn raw data into actionable insights and reduce the time underwriters spend on data entry and verification.

Automated Decision-Making for Simple Cases

For simple lending scenarios, AI can now apply predetermined criteria to make instant approval or rejection decisions.

This ability is particularly useful for high volume, low complexity cases where the underwriting process follows established rules.

Risk Scoring and Assessment

One of the most powerful uses of AI in underwriting is advanced risk models that can process hundreds of variables at once.

Blooma’s stress testing, for example, allows lenders to simulate different economic scenarios and see how commercial properties would perform under different conditions – a level of analysis that would take much longer to do manually.

Fraud Detection

AI has proven to be very good at identifying anomalies that may indicate fraud.

By scanning for unusual patterns across thousands of applications, AI flags potential issues for human investigation, adding an extra layer of security to the underwriting process.

Potential Benefits of AI in Underwriting

The adoption of AI in underwriting offers several compelling advantages:

- Increased Efficiency and Speed: Commercial lending software powered by AI accelerates decision-making times. What used to take weeks can now be done in days or hours. This reduces operational costs and improves the customer experience by getting loan applications responded to faster.

- Improved Accuracy and Consistency: Human underwriters, no matter how skilled, can't match the consistency of well-designed AI systems that operate at 100% capacity. Technology eliminates the variability that comes with different underwriters handling similar applications, ensuring that the same standards are applied across all cases.

- Enhanced Risk Assessment: The most advanced AI models can identify subtle correlations and risk factors that even experienced underwriters might miss. By analyzing historical data across thousands of previous loans, these systems develop a deep understanding of what makes a commercial property a good or bad investment.

- Greater Scalability: As lending institutions grow their underwriting departments often struggle to scale. AI tools allow companies to handle large increases in application volume without proportionate increases in staff, creating a more agile business model.

Limitations and Challenges of AI in Underwriting

Despite its impressive capabilities, AI faces important limitations in the underwriting space:

- Lack of Human Judgment and Nuance: Commercial real estate lending involves complex, one-off properties that don’t fit into pre-defined categories. In these cases, human judgment is key. An experienced underwriter can see the special circumstances, understand the story behind the anomalies, and make informed exceptions when needed – something even the most advanced AI systems struggle with.

- Data Bias and Fairness: AI models learn from historical data and may perpetuate past biases in lending decisions. This is a big ethical issue around fairness and accessibility in lending. Human intervention is needed to ensure equitable outcomes and to know when models are reproducing bad patterns.

- Explainability and Transparency: Many AI systems are “black boxes,” making decisions through processes that can’t be explained. Lack of transparency creates problems for accountability, regulatory compliance, and client communication. Borrowers deserve to know why their application was approved or denied, which gets tricky when decisions come from complex algorithms.

- Regulatory Compliance: The regulatory landscape for lending is complex and ever-changing. Human underwriters understand the spirit of the regulations and can adapt to new requirements in context. AI systems need to be updated continuously and, even then, may struggle with grey areas of regulation.

The Future of the Underwriter: Augmentation, Not Replacement?

AI will certainly change underwriting, but the evidence suggests it will augment rather than replace human underwriters. Here’s why.

Strategic Decision-Making Remains Human

CRE software can analyze data and make recommendations, but strategic decisions around portfolio balance, relationship management and exception cases still require human expertise.

As the routine tasks get automated, underwriters will focus more on these high-value activities.

Upskilling Rather Than Replacing

Forward-thinking organizations use AI to upskill their underwriting teams rather than downsize them. By removing the burden of manual data entry and basic analysis, technology frees up underwriters to develop deeper expertise and spend more time on complex cases.

Remember, many jobs in underwriting and investing niches aren’t disappearing – they’re simply evolving.

Leadership in AI Integration

Successful implementation of AI in underwriting requires leadership to decide which processes to automate and which to keep human-centered.

Mortgage lending software works best when deployed strategically with executives who understand both technology and human capabilities.

The Human-AI Partnership

The best approach treats AI as a partner to human underwriters rather than their replacement. In this model, AI handles data processing, pattern recognition, and routine tasks while humans provide oversight, manage relationships with brokers and clients, and make final decisions on complex cases.

Blooma does this by using AI to augment human capabilities, not replace them. By automating the data collection and analysis, the platform allows underwriters to focus on the art of underwriting rather than the mechanics.

The Evolving Relationship Between AI and Underwriters

The question “Will AI replace underwriters?” is the wrong one to be asking. If that’s where you’re at, you’re missing the point.

While some underwriting parts will be automated, the role itself is evolving, not disappearing. Tomorrow’s underwriters will use AI agents to do the repetitive work while they focus on relationship building, complex analysis, and strategic decision making.

The most successful companies in the next few years will be those that leverage technology as a way to empower human talent rather than by seeking means to replace it.

Commercial real estate software like Blooma is an example of this in action. With Blooma, you can use AI to do the mechanical parts of underwriting so human professionals can focus on where they add the most value.

For underwriters worried about being replaced, the message is clear: adaptability is key. Those who learn to work alongside AI, using it to enhance their skills while developing the uniquely human skills of relationship management, creative problem solving, and strategic thinking, will thrive in this new world.

The verdict?

The future of underwriting isn’t human or machine. It’s human and machine working together, each contributing their strengths to create outcomes neither could do alone. In this partnership lies the true potential of AI in commercial real estate: to raise humans to their highest and best use.

Get started with Blooma today and learn how to make the best of both!