Key Takeaways:

- Credit risk analytics in CRE is shifting from manual spreadsheets and periodic reviews to AI-powered, real-time monitoring that reduces delays and errors.

- Outdated methods create major risks including lagging insights, data silos, inconsistent underwriting, and limited stress testing that leave lenders exposed.

- Blooma’s Origination Intelligence automates data extraction, scoring, and triage, while Portfolio Intelligence delivers continuous monitoring and proactive alerts.

- Institutions using Blooma have achieved measurable gains, such as cutting processing times and increasing deal volumes without adding headcount.

- By streamlined compliance, empowering expert judgment, and scaling efficiency, Blooma transforms credit risk management into a proactive growth strategy.

The Evolving Challenge of Credit Risk

Managing credit risk in the commercial real estate landscape can make all the difference between sustainable growth and expensive losses. But in a complex market, are your current analytics giving you the complete, real-time picture?

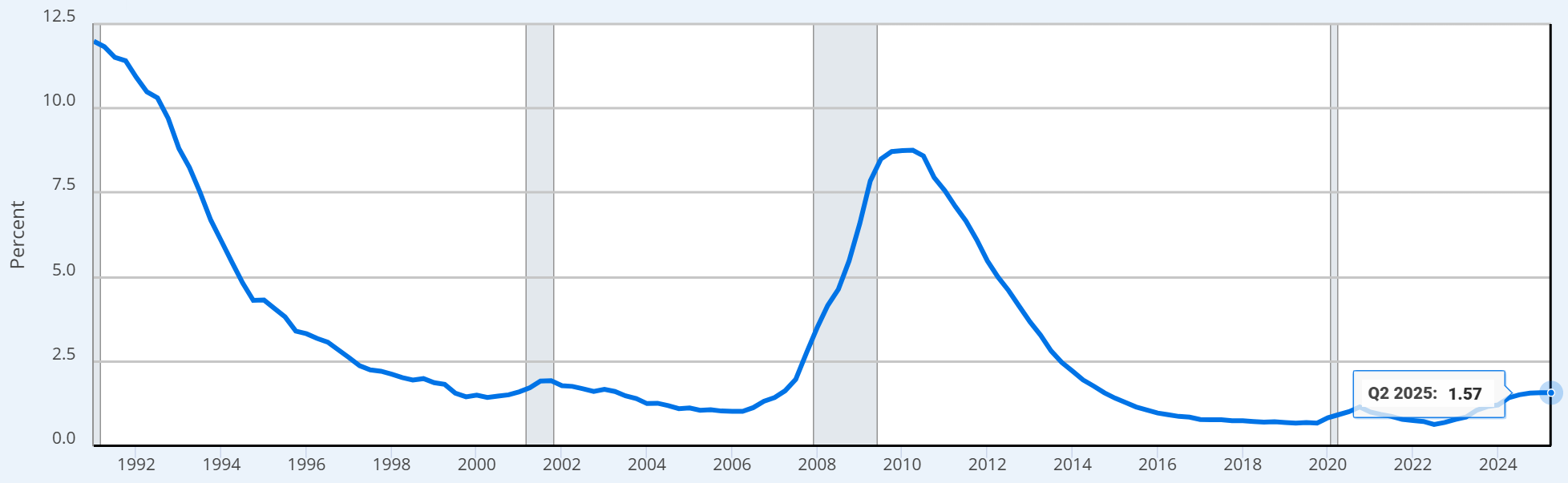

The delinquency rate on U.S. commercial real-estate loans (excluding farmland) rose to 1.57% in Q2 2025—the highest level in a decade.

Source: FRED

Credit risk analytics involves:

- Assessing a borrower’s ability to repay;

- Evaluating collateral value and market conditions;

- Quantifying potential loss across a portfolio of loans.

Traditional methods involving manual spreading, annual reviews, and siloed spreadsheets are now obsolete. The future lies in intelligent automation, continuous data feeds, and cross-team alignment.

However, the most significant risk isn’t just outdated tools. It’s misalignment across teams:

- Originations team pushing for speed.

- Credit teams focused on accuracy and protection.

- Strategy leaders demanding modernization.

Juggling competing priorities amid rising interest rates and market uncertainty often leads to slow, fragmented decision-making and missed opportunities.

Blooma is an AI-powered platform built by industry experts to transform credit-risk analytics in CRE lending. Our platform helps you align stakeholders around a shared, real-time view of risk, enabling your institution to move faster without compromising accuracy.

Through our Origination Intelligence and Portfolio Intelligence suites, Blooma gives you the visibility and control required in today’s market.

In this article, we’ll review the limitations of manual risk analysis and detail how Blooma’s AI-driven platform provides the proactive, real-time analytics needed to unify teams, modernize credit workflows, and strengthen portfolio performance.

The Failures of Traditional Risk Management

Lagging Insights

- Relying on annual or semi-annual reviews means risk often appears only after a significant deterioration.

- When performance reporting is lagged by a quarter, the probability of default increases by 3.77 basis points, indicating a 9.5% higher default risk than the average baseline.

Manual Data Collection and Spreading

- Analysts often spend hours transcribing borrower financials into spreadsheets—a slow, costly process prone to compounding errors.

- Even a seemingly minor $20 misentry can snowball into $1,000+ in discrepancies by closing if not caught early, forcing the origination process to be rerun.

Inconsistent Underwriting

- Without standardized inputs, each underwriter works in a different/unique way.

- It leads to inconsistent assessments across the portfolio, making comparability and risk aggregation difficult.

Limited Stress Testing

- Manual scenario modelling is often too complex and time-consuming, so your teams may avoid running it altogether or only test for the most obvious risks.

- Many institutions cannot efficiently run multivariable stress tests, limiting visibility into downside risk.

Data Silos

- Risk data often lives disconnected from origination and deal-data systems.

- This prevents a unified view of borrower history, exposures, and early warning signals—leaving lenders in reactive mode.

The Blooma Transformation: AI-Driven Credit Risk Analytics

Origination Intelligence

- Automated Data Standardization: With Blooma, data extraction from borrower documents (rent rolls, tax returns, financials) happens immediately, reducing manual transcription and increasing accuracy.

- Standardized Risk Scoring: Every deal is scored using consistent, configurable risk parameters—eliminating subjective underwriter variation and improving portfolio comparability.

- Rapid Deal Triage: High-value or fast-track opportunities are identified automatically, while high-risk deals are flagged for expert review, so your team can focus on critical tasks.

Portfolio Intelligence

- Real-time Risk Monitoring: Blooma continuously ingests market, property, and borrower data to give you live visibility into loan health and emerging exposures.

- Advanced Stress Testing: Your team can run multivariable stress tests in minutes, modelling shifts in vacancy rates, interest rates, cap rates, DSCR, and LTV across the portfolio.

- Concentration Risk Identification: Blooma visualizes loan concentrations by geography, property type, and borrower—so you can spot risk clusters that manual workflows often miss.

- Proactive Alerts: When portfolio performance deviates from underwriting assumptions, Blooma sends immediate alerts—enabling you to act before the issues escalate.

Strategic Benefits: The ROI of Intelligent Risk

Reduced Losses and Risk Mitigation

- With proactive alerts and real-time analytics, you can spot risk elements before they turn into a loss.

- For instance, in Q4 of 2023, CRE mortgages maturing within three years equaled about 27% of banks’ market-to-market capital and roughly 16% of aggregate CRE debt, underscoring how sudden losses can swell.

- Blooma’s predictive engine helps avoid such surprises and keep losses manageable.

Operational Efficiency

Consistent Compliance and Audit Readiness

- Standardized data flows and detailed audit trails make regulatory reviews smoother.

- Institutions without formal monitoring systems frequently fall short on stress-testing and concentration reporting.

- In fact, a study by the FDIC highlighted that nearly a third of banks in regions like Chicago and New York already held CRE exposures above 300% of capital.

Empowered Human Expertise

- Automating routine tasks means your analysts and risk managers spend less time as data entry clerks and more time using their judgment.

- Blooma handles extraction, scoring, and alerts—your team gets to focus on strategy, not spreadsheets.

Scalable Growth

- As your loan book grows, manual processes break down.

- A mid-market bank increased deal volume by 67% while scaling operations.

- With Blooma, you monitor more loans, cover more ground, and expand without ballooning headcount.

Focus on Strategy, Not Surveillance

Blooma was built by seasoned CRE lending experts with one mission: to free institutions from the burden of manual workflows and give them the space to focus on growth.

By applying Intelligent Automation to every stage of risk analytics, Blooma shifts your team’s energy from repetitive surveillance to strategic decisions and stronger client relationships.

Are you ready to transform your credit risk management from a manual, reactive task into a confident, proactive strategy? Discover how Blooma’s AI-powered platform delivers the credit risk analytics you need to fortify your portfolio. Schedule a personalized demo today!